Loading

Get Idapp Forbearance Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Idapp Forbearance Form online

Filling out the Idapp Forbearance Form online can be a straightforward process with the right guidance. This comprehensive guide provides step-by-step instructions for each section of the form to help users navigate the online submission confidently.

Follow the steps to complete the Idapp Forbearance Form online.

- Press the ‘Get Form’ button to obtain the form and open it in your designated online editor.

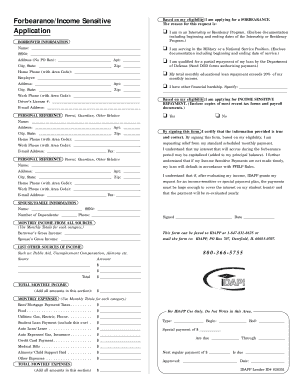

- Start filling out the borrower information section. Enter your full name, social security number, and address details such as apartment number, city, state, and zip code. Provide your home phone number and include your employer information and address if applicable.

- Indicate eligibility by checking the applicable boxes related to your situation, such as being in an internship or residency program, military service, partial repayment qualification, or financial hardship. If selecting the last option, be sure to specify your situation.

- Provide your work phone number and email address in the designated fields.

- Move on to the personal references section. You will need at least one reference; fill in the necessary information such as name, relationship type, address, phone numbers, and email information.

- Sign the form, certifying that all provided information is accurate. This step is crucial as it confirms your request for relief from your standard scheduled monthly payment.

- Input your spouse/family information, if applicable, by providing their name, social security number, number of dependents, and contact information.

- Fill out the monthly income section with all applicable sources, including your gross income and any additional income from other sources. Be thorough and accurate for a comprehensive picture of your financial situation.

- List your monthly expenses, including rent/mortgage, food, utilities, and any loan payments. Ensure the amounts are correct and reflect your current financial commitments.

- Review all sections for accuracy and completeness before saving your changes. Once satisfied, you can choose to download, print, or share the completed form as needed.

Get started today and complete your documents online with ease.

Most types of forbearance are not automatic—you need to submit a request to your student loan servicer, often using a form. Also, for some types of forbearance, you must provide your student loan servicer with documentation to show that you meet the eligibility requirements for the forbearance you are requesting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.