Loading

Get 1902 Ap

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1902 Ap online

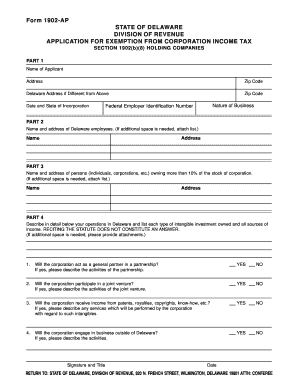

Filling out the 1902 Ap form online can seem daunting, but with a clear guide, you can complete it easily. This application for exemption from corporation income tax is essential for holding companies in Delaware, and understanding its components is crucial.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to retrieve the 1902 Ap form and access it in your online editor.

- Begin with Part 1 by filling in the name of your organization as the applicant, followed by the address, including the zip code. If your Delaware address differs from the one provided, include it along with its zip code.

- Indicate the date and state of incorporation, followed by describing the nature of your business clearly. Don’t forget to input your Federal Employer Identification Number.

- In Part 2, list the names and addresses of any Delaware employees your corporation has. If further space is needed, attach an additional list.

- Move to Part 3 and provide the names and addresses of individuals or entities that hold more than 10% of the corporation's stock. Again, you can attach a list if you need more space.

- In Part 4, describe your operations in Delaware thoroughly. List each type of intangible investment owned and document all sources of income. Remember, simply reciting the statute will not suffice.

- Answer the questions regarding your corporation’s involvement in partnerships, joint ventures, and income from intangibles such as patents or royalties. Provide descriptions as necessary for each question.

- Finally, indicate whether the corporation will engage in business outside of Delaware and describe any relevant activities.

- Sign and date the form in the designated section to affirm the accuracy of the information.

- After completing all sections, save your changes, download the completed form, print it, or share it as needed.

Complete your documents online to streamline your filing process!

A PARTNERSHIP RETURN MUST BE COMPLETED BY ANY BUSINESS TREATED AS A PARTNERSHIP FOR FEDERAL PURPOSES WHICH HAS ANY INCOME OR LOSS, REGARDLESS OF AMOUNT, DERIVED FROM OR CONNECTED WITH A DELAWARE SOURCE. IF THE PARTNERSHIP HAS NO DELAWARE SOURCED INCOME OR LOSS, NO RETURN IS REQUIRED TO BE FILED.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.