Loading

Get 1) Fill Out A 1040 Tax Form In Order To Find The Amount Of Income Tax ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out a 1040 tax form in order to find the amount of income tax online

Filling out a 1040 tax form is essential for understanding your income tax obligations. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring you make accurate calculations concerning your taxes.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editor.

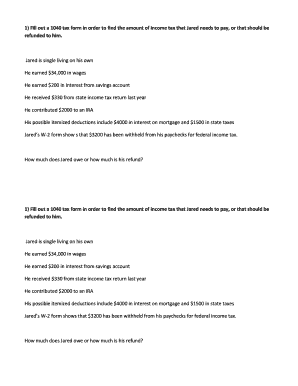

- Begin by entering your personal information in the designated fields, including your name, address, and filing status. For this example, Jared is single and living alone.

- Report your income. Input Jared's total wages of $34,000 in the income section. Additionally, include his $200 in interest earned from a savings account.

- Calculate the adjusted gross income (AGI). Since Jared contributes $2,000 to an IRA, subtract this amount from his total income.

- Add any possible deductions. In Jared's case, he may have itemized deductions, including $4,000 in mortgage interest and $1,500 in state taxes.

- Determine whether to itemize deductions or take the standard deduction. Evaluate which option offers a greater benefit; in this case, calculate totals for each.

- Complete the tax computation section to find out the amount owed or refunded. Take into account that Jared had $3,200 withheld from his paychecks for federal income tax.

- Review all entered information for accuracy. After confirming everything is correct, you can save the form.

- Download, print, or share the completed tax form as necessary.

Prepare your tax obligations by filling out your form online today!

Find your 1040, or the IRS form used to calculate your annual personal federal income taxes, for a given year. Turn to page 2, and look at line item 16. Line item 16 shows your "total tax," which is the total amount you paid in taxes for the year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.