Loading

Get 001c Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 001c Form online

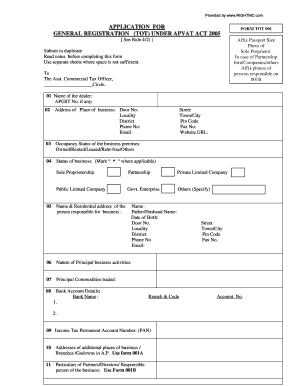

Filling out the 001c Form online is a straightforward process designed to facilitate the general registration under the APVAT Act 2005. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the 001c Form online

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the name of the dealer as you wish to be registered under the APVAT Act 2005 in the specified field.

- Fill out the address of your place of business, including door number, street, locality, town/city, and pin code to provide accurate location details.

- Indicate the occupancy status of your business premises by selecting the most appropriate option from owned, rented, leased, rent-free, or others.

- Mark the status of your business by selecting the relevant category such as sole proprietorship, partnership, private limited company, etc.

- Provide the name and residential address of the person responsible for the business, ensuring all required details are included.

- Describe the nature of your principal business activities in the designated field.

- List the principal commodities traded by your business with clear descriptions.

- Fill in your business bank account details, including bank name, branch, and account number.

- Indicate your Income Tax Permanent Account Number (PAN) as issued by the Income Tax Department.

- If applicable, enter the addresses of additional places of business, branches, or godowns using the designated Form 001A.

- For particulars of partners or directors, use Form 001B, which contains the necessary fields.

- Provide your taxable turnover for the last 12 consecutive months in the specified field.

- Indicate your estimated taxable turnover for the next 12 consecutive months.

- Specify the date on which the taxable turnover for 12 consecutive months exceeded Rs. 5 lakhs.

- If applicable, enter your registration number under the Profession Tax Act.

- Review all provided information for accuracy before submitting.

- Once completed, save your changes, and utilize the options to download, print, or share the form as necessary.

Begin your online application process for the 001c Form today.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.