Loading

Get Conventional Attached Only Pud Questionnaire - Afrwholesale Bb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Conventional Attached Only PUD Questionnaire - AFRWholesale Bb online

Filling out the Conventional Attached Only PUD Questionnaire - AFRWholesale Bb can be made simpler with the right guidance. This guide provides clear instructions on how to complete each section of the form efficiently and accurately, ensuring you provide all necessary information.

Follow the steps to complete the questionnaire online.

- Click ‘Get Form’ button to obtain the form and open it in the editor for further completion.

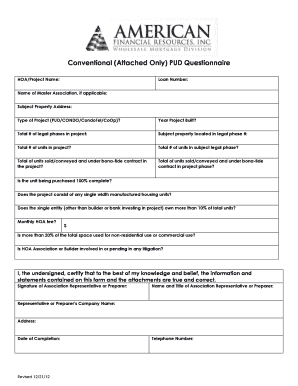

- Begin with entering the HOA/Project Name in the designated field. This should reflect the official name of the homeowners association or project that you are referencing.

- Fill in the Loan Number, which is essential for tracking the financing associated with the property.

- If applicable, provide the Name of the Master Association next. This is necessary for properties that are part of a larger community association.

- Input the Subject Property Address accurately to ensure proper identification of the property in question.

- Select the Type of Project from the options provided, whether it be PUD, CONDO, CondoTel, or CoOp.

- Enter the Year Project Built to give context to the property’s age. This information is crucial for underwriting purposes.

- Indicate the Total # of legal phases in project and the Subject property located in legal phase # to clarify the development structure.

- Complete the Total # of units in project and Total # of units in subject legal phase fields, which reflect the scale of the development.

- Provide the Total of units sold/conveyed and under bona-fide contract in the project and project phase to show the activity and market viability.

- Answer whether the unit being purchased is 100% complete, as this impacts potential financing options.

- If applicable, indicate whether the project consists of any single width manufactured housing units.

- Determine if a single entity (other than the builder or bank investing in the project) owns more than 10% of the total units, a critical consideration for loan eligibility.

- Fill in the Monthly HOA fee amount, which is a recurring cost that must be factored into household budgets.

- Address whether more than 20% of the total space is used for non-residential or commercial use, as this may affect the classification of the project.

- Confirm if the HOA Association or Builder is involved or pending in any litigation, which could pose risks to potential buyers.

- Once all required fields are complete, certify that the information is true and correct by providing the Signature of Association Representative or Preparer.

- Finish by entering the Name and Title of the Association Representative or Preparer, along with their Company Name, Address, and Date of Completion.

- Lastly, include the Telephone Number for any follow-up communications, ensuring all contact information is up to date.

- After reviewing your entries for accuracy, proceed to save changes, download the document, print it, or share the completed form as needed.

Complete your documents online today for efficient processing!

What is the difference between a Fannie Mae loan and a conventional loan? They are the same. Conventional loans are the mortgages purchased by the government-sponsored enterprises of Fannie Mae and Freddie Mac.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.