Loading

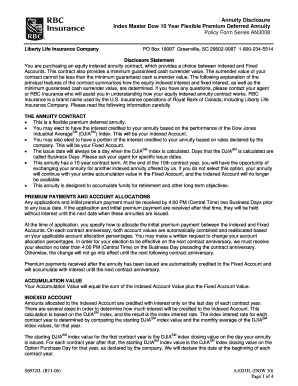

Get Annuity Disclosure Index Master Dow 10 Year Flexible Premium Deferred Annuity Policy Form Series

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Annuity Disclosure Index Master Dow 10 Year Flexible Premium Deferred Annuity Policy Form Series online

This guide provides a comprehensive overview of how to effectively fill out the Annuity Disclosure Index Master Dow 10 Year Flexible Premium Deferred Annuity Policy Form Series online. Following these instructions will ensure that users can complete the form accurately and confidently.

Follow the steps to complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the disclosure statement carefully. This section outlines the key features of your annuity contract, including the choice between Indexed and Fixed Accounts.

- In the section titled 'The Annuity Contract', indicate your preference for interest crediting based on the performance of the Dow Jones Industrial Average or the company-declared rates for the Fixed Account.

- Fill out the premium payment details, ensuring that you allocate your initial premium payment appropriately between Index and Fixed Accounts. Remember to submit your application before the 4:00 PM (Central Time) cutoff for proper processing.

- Complete the 'Accumulation Value' section by understanding how values from both accounts contribute to your total value.

- If applicable, sign the form where indicated to confirm your application and agreement to the terms.

- Review all entries for accuracy before proceeding. Ensure you have filled in any necessary sections regarding cash surrender value or withdrawal charge schedules.

- Once completed, save your changes, download the form, and print or share it as necessary.

Start filing your forms online today to secure your financial future.

Deferred annuities may be purchased with either a single lump sum or a series of payments over time. Single premium deferred annuities (SPDAs) require only one payment at the time the contract is established, whereas flexible-premium deferred annuities allow the purchaser to pay in multiple installments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.