Loading

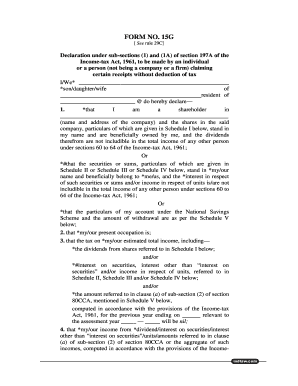

Get 15g See Rule 29c Declaration Under Sub-sections (1) And (1a) Of Section 197a Of The Income-tax Act

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 15G See Rule 29C Declaration Under Sub-sections (1) And (1A) Of Section 197A Of The Income-tax Act online

This guide provides step-by-step instructions on how to complete the 15G See Rule 29C Declaration under the Income-tax Act online. By following these clear instructions, users can ensure proper submission of the form without tax deductions on certain receipts.

Follow the steps to complete the declaration effectively.

- Click 'Get Form' button to obtain the form and open it in your preferred editor.

- Begin by filling in your name at the top of the form as the declarant, specifying whether you are the son, daughter, or partner of the relevant surname. Ensure you list your residential address following this information.

- In the first declaration section, specify whether you are a shareholder or are receiving income from securities, including details from the appropriate schedules as required.

- Indicate your current occupation in the next section and provide relevant information about your estimated total income, stating why it will result in nil tax under the Income-tax Act.

- Confirm whether you have been assessed to income-tax previously and provide the relevant details, if applicable.

- In the section pertaining to residency, indicate your status as a resident or non-resident in India according to the Income-tax definitions.

- Fill out the schedules provided with the necessary details about shares, securities, sums under the National Savings Scheme, or any other relevant financial information.

- Sign the form, ensuring the verification statement reflects the accuracy of the information provided.

- Finally, review the completed form for accuracy before saving your changes, downloading, printing, or sharing the document as needed.

Complete your 15G declaration online today to simplify the tax deduction process on your income.

Sub-section (1C) of section 197A of the Income-tax Act, 1961 (the Act) read with rule 29C of the Rules, inter alia, provides that no deduction of tax shall be made in case of a resident individual, who is of the age of sixty years or more, if he furnishes a declaration in Form 15H to the person responsible for paying ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.