Loading

Get 'form No. 13 See Rules 28 And 37g Application By A Person For A ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 'FORM NO. 13 See Rules 28 And 37G Application By A Person For A ... online

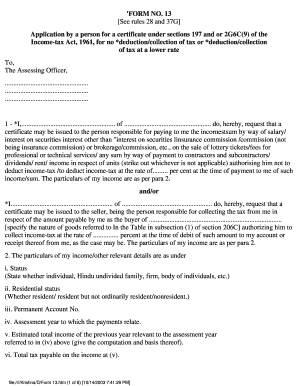

This guide provides step-by-step instructions to assist users in completing the 'FORM NO. 13' application for a certificate under the Income-tax Act, 1961. Understanding each section and its requirements will simplify the online filing process.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to access the form in the online editor.

- Begin by filling in your personal details in the opening section, including your name and address. Clearly state whether this application is for tax deduction or collection.

- Provide details about your income in the section labeled 'Particulars of my income/other relevant details.' This includes your status, residential status, Permanent Account Number, assessment year, and estimated total income.

- Complete the financial details regarding tax liability, average rate of tax, prior assessments, and advance tax already paid.

- Fill out the Annexures appropriately based on whether you are applying for no deduction/collection of tax or at a lower rate. Include all relevant details in the provided schedules.

- Review your entries thoroughly to ensure accuracy and completeness. Confirm that all necessary fields are filled out.

- Once you are satisfied with the information provided, proceed to save changes to the form. You may also download, print, or share the completed document as required.

Complete your documents online today for a streamlined filing experience.

Under Section 197, you should amortize all acquired intangible assets over 180 months, or 15 years, regardless of the asset's useful life. Amortization of Section 197 assets is done on a straight-line basis. This means that each year for 15 years, you will deduct 1/15th of the acquisition cost of that amortized asset.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.