Loading

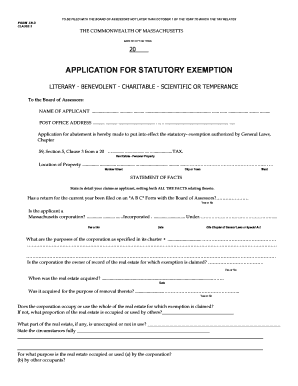

Get Form 1b3 Charitable - Town Of Middleborough

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1B3 Charitable - Town Of Middleborough online

Filling out the Form 1B3 Charitable for the Town of Middleborough can seem daunting, but with this guide, you will find the process straightforward and manageable. This form is essential for those seeking a statutory exemption for their charitable, literary, or scientific purposes.

Follow the steps to successfully complete your application.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the 'Name of Applicant' field, enter the full legal name of the organization applying for the exemption.

- Fill in the 'Post Office Address' section with the complete address of the organization, ensuring accuracy.

- Specify the year for which the tax exemption is being requested in the '20____' field.

- Select whether the property is classified as real estate or personal property under the location of property section, and provide the corresponding details (number, street, city or town, and ward).

- In the 'Statement of Facts' section, provide a detailed explanation of the claims being made, presenting all relevant facts clearly.

- Indicate whether a return for the current year has been filed on an 'A B C' form with the Board of Assessors by selecting 'Yes' or 'No.'

- State if the applicant is a Massachusetts corporation by choosing 'Yes' or 'No' and specify the incorporation details.

- Enumerate the purposes of the corporation as stated in its charter in the respective field.

- Confirm the corporation's ownership of the real estate for which the exemption is claimed by selecting 'Yes' or 'No.'

- Document the acquisition date of the real estate and specify if it was acquired for the removal purpose.

- Clarify the extent to which the corporation occupies the real estate and detail any unoccupied portions.

- Explain how the real estate is used, stating the purpose for both the corporation and any other occupants.

- Provide information regarding the revenue generated from the property, both for rental and for other uses.

- Indicate if any profits are divided among shareholders or members, and describe the purpose of the income generated.

- Conclude by stating any other relevant facts that may support the right to exemption.

- Finally, sign and date the application, ensuring the submission is under the penalties of perjury.

- After filling out all sections, you can save changes, download, print, or share the completed form as needed.

Take action now and complete your Form 1B3 Charitable online to ensure timely submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.