Loading

Get Matching Gift Program - Norfolk Southern

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Matching Gift Program - Norfolk Southern online

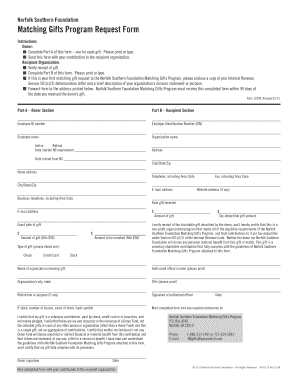

The Matching Gift Program offers an opportunity for Norfolk Southern employees to have their charitable donations matched, maximizing their impact on eligible non-profit organizations. This guide provides a clear and structured approach to filling out the program's form online, ensuring that you can successfully participate.

Follow the steps to effectively complete the Matching Gift Program form.

- Click the ‘Get Form’ button to access the Matching Gift Program form and open it in your online editor.

- In Part A, complete the donor section by entering your employee ID number, name, address, and contact information. Ensure all details are accurate and up to date.

- Specify your employment status by checking 'Active' or 'Retired' as applicable, and indicate your start date at Norfolk Southern.

- Provide the amount of your gift in the designated field, making sure it meets the minimum tax-deductible contribution of $50.

- Confirm the type of gift you are making by selecting the appropriate option: Check, Credit Card, or Stock. If applicable, include the necessary details regarding the stock (number of shares, name of stock, trade symbol).

- Sign and date the donor signature section. This confirms the validity of your contribution and ensures compliance with the program guidelines.

- Once Part A is complete, send the original form, along with your contribution, to the recipient organization.

- The recipient organization must fill out Part B of the form. Ensure they complete the verification process, sign, and send it back to the Norfolk Southern Foundation within 90 days.

- After submission, keep a record of your form and contribution details. This will assist you with any future inquiries regarding the matching gift process.

Start filling out your Matching Gift Program form online today to maximize your charitable contributions.

Who gets credit for the matching gift? While your donor applied for the match, the matching gift company made the gift. Therefore, the company should receive the credit for the matching amount. Your donor should only receive credit for the original amount they donated.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.