Loading

Get Participant Distribution Election Form - Abgwi.com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PARTICIPANT DISTRIBUTION ELECTION FORM - ABGWI.com online

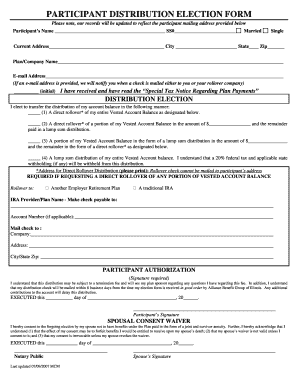

Filling out the Participant Distribution Election Form is an important step in managing your retirement account. This guide provides clear, step-by-step instructions to help you complete the form online with ease.

Follow the steps to accurately complete the form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter your participant's name and Social Security number in the designated fields at the top of the form.

- Indicate your marital status by selecting either 'Married' or 'Single'.

- Fill in your current address, including the city, state, and zip code.

- Specify the plan or company name associated with your account.

- If you wish to receive email notifications regarding your check, provide your email address.

- Initial the box confirming you have read the 'Special Tax Notice Regarding Plan Payments'.

- In the Distribution Election section, select one of the options provided for how you wish to transfer your account balance.

- If opting for a direct rollover, print the address where the rollover check should be sent. You cannot have the check mailed to your personal address.

- Fill out the required details for the rollover destination, including the name of the financial institution and account number, if applicable.

- Review the PARTICIPANT AUTHORIZATION section and provide your signature confirming your understanding of the distribution terms.

- Complete the date and sign the document where indicated.

- If applicable, have your spouse sign the SPOUSAL CONSENT WAIVER section, and ensure it is notarized.

- Once all fields are completed, save your changes, and choose to download, print, or share the form online as needed.

Complete your form online today to ensure your retirement account is managed according to your preferences.

Distributions to investors up to their cost basis—the amount invested, including commissions and fees—in the stock is considered a non-taxable return of principal. Amounts above investors' cost basis are reported as capital gains, a taxable distribution.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.