Loading

Get Upward Variation Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Upward Variation Form online

This guide provides step-by-step instructions for successfully completing the Upward Variation Form online. By following these instructions, you will ensure that the necessary information is submitted accurately and efficiently.

Follow the steps to complete the Upward Variation Form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

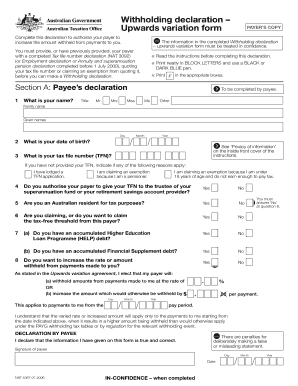

- Begin filling out Section A, which is the Payee’s declaration. Start by entering your legal name in the designated fields for title, family name, and given names.

- Input your date of birth by selecting the appropriate day, month, and year from the provided options.

- Enter your tax file number (TFN) in the specified field. If you have not provided a TFN, indicate any applicable reasons and ensure you follow the guidelines for providing alternative information.

- Respond to questions regarding your TFN authorization for superannuation, residency status for tax purposes, and whether you are claiming the tax-free threshold.

- Address questions regarding any existing Higher Education Loan Programme (HELP) debt or Financial Supplement debt, and make your selection regarding the withholding amount or rate.

- Confirm your election regarding the amount you wish to be withheld and ensure the varied rate or increased amount is correctly filled out, indicating the start date.

- Finalize the declaration by signing and dating the form to confirm that all provided information is true and correct.

- After completing the form, save your changes. You can then download, print, or share the form as needed.

Complete your Upward Variation Form online today to ensure accurate withholding from your payments.

Upward variations An upwards variation increases the amount of tax that is withheld from your payments. You can ask your payer to increase the amount they withhold from your income. You may do this where you expect to have a tax amount to pay at the end of the income year. Example: upward variation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.