Loading

Get Qesi Transfer Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Qesi Transfer Form online

Completing the Qesi Transfer Form online is essential for transferring funds between registered education savings plans. This guide will help you navigate the process efficiently and accurately, ensuring all necessary information is provided.

Follow the steps to fill out the Qesi Transfer Form online.

- Press the ‘Get Form’ button to access the form and open it in your chosen online editor.

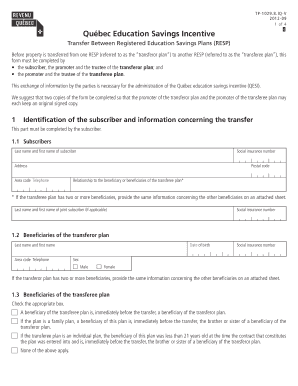

- Begin with the identification of the subscriber. Enter your last name and first name, social insurance number, address, and telephone number. Ensure you include your postal code. Indicate your relationship to the beneficiary or beneficiaries of the transferee plan, and if there’s a joint subscriber, provide their information as well.

- Next, move to the section for beneficiaries of the transferor plan. Fill in the last name and first name of each beneficiary, their date of birth, and social insurance number. Specify their sex. If additional beneficiaries are present, include their details on an attached sheet.

- Proceed to describe the beneficiaries of the transferee plan by checking the applicable boxes related to their relationship with beneficiaries of the transferor plan.

- In the subscriber’s instructions section, request the transfer by providing the contract numbers for both the transferor and transferee plans. Confirm if the value of the transferred property matches the account balance. Specify whether it is money or property in kind.

- Complete the information regarding the transferee plan. Enter the name of the promoter, addresses, and the specimen plan number assigned by the CRA, along with other relevant contract numbers for the plan type.

- Fill in the information for the transferor plan similarly by providing details of the promoter, addresses, and contract numbers. Additionally, record pertinent financial figures related to the transfer.

- Finally, ensure that all sections are reviewed for accuracy. Once satisfied, save your changes. You can then proceed to download, print, or share the completed form as needed.

Start completing your Qesi Transfer Form online today!

An RESP can remain open for a maximum of 35 years, with a lifetime contribution limit of $50,000 per beneficiary. When your beneficiary enrolls at an eligible post-secondary institution and you are ready to withdraw the funds for educational purposes, the payments can be made from these funds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.