Loading

Get Provider W-9 Form - Child Care Resource & Referral

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Provider W-9 Form - Child Care Resource & Referral online

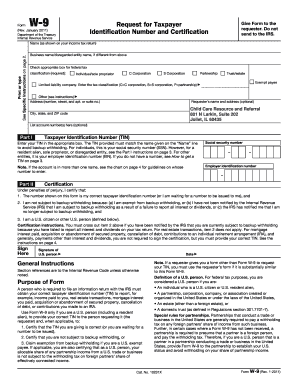

The Provider W-9 Form is an essential document for individuals and businesses to provide their taxpayer identification number to those requesting it. This guide will help you navigate the online process of completing the form with clear instructions for each section.

Follow the steps to fill out your Provider W-9 Form online.

- Press the ‘Get Form’ button to download the Provider W-9 Form and open it in your preferred online editor.

- Enter your name as it appears on your income tax return in the first field of the form. If you have a business name that differs from your personal name, fill that in the 'Business name/disregarded entity name' section.

- Check the appropriate box for your federal tax classification, such as 'Individual/sole proprietor,' 'C Corporation,' or 'S Corporation.' This classification determines how your income is reported.

- Provide your complete address, including any apartment or suite numbers. This will be used for correspondence regarding your tax information.

- In Part I, enter your Taxpayer Identification Number (TIN) in the designated boxes. For individuals, this is typically your Social Security Number (SSN); for businesses, it is your Employer Identification Number (EIN).

- Read and certify the information provided in Part II of the form. This includes confirming that the TIN is correct and that you are not subject to backup withholding, unless indicated otherwise.

- Sign and date the form where indicated to validate your information. This step is crucial for the submission of your W-9.

- Finally, save your changes, and you can download, print, or share the completed Provider W-9 Form as needed.

Complete your Provider W-9 Form online today to ensure compliance and streamline your tax reporting.

Related links form

The person or business paying you is responsible for requesting the W-9 Form from you. However, the requester has no obligation to file the W-9 with the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.