Loading

Get Customer Declaration Form For Availing Foreign Exchange Hdfc Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Customer Declaration Form for availing foreign exchange HDFC Bank online

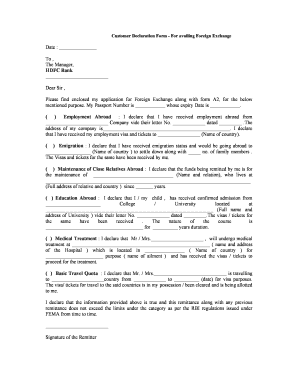

The Customer Declaration Form for availing foreign exchange at HDFC Bank is a crucial document for users seeking to send money abroad. This guide provides a comprehensive step-by-step approach to filling out the form accurately and efficiently online.

Follow the steps to complete your customer declaration form seamlessly.

- Click the ‘Get Form’ button to access the Customer Declaration Form for availing foreign exchange.

- Begin by entering the date at the top of the form, which indicates when you are filling out this declaration.

- Address the form to ‘The Manager, HDFC Bank,’ filling in the branch name as necessary.

- In the main section of the letter, specify your purpose for applying for foreign exchange by selecting one of the following options: Employment Abroad, Emigration, Maintenance of Close Relatives Abroad, Education Abroad, Medical Treatment, or Basic Travel Quota.

- Depending on your selected purpose, provide the required details: for Employment, include your passport number, employment company details, and visa information; for Emigration, include the country and family member details; for Maintenance, state the relative's name, relation, and address; for Education, provide the institution's name, address, course, and duration; for Medical Treatment, include the hospital's details and medical purpose; for Basic Travel Quota, state the traveler’s name, travel dates, and visa status.

- Make sure that you declare that the information provided is true and does not exceed the limits set by the Reserve Bank of India (RBI) rules under the Foreign Exchange Management Act (FEMA).

- Finally, sign the document as the remitter to validate your declaration.

Complete your Customer Declaration Form online today to ensure a smooth foreign exchange transaction.

Under the Liberalised Remittance Scheme (LRS), the Indian government and the Reserve Bank of India (RBI) now require an LRS Declaration form (fully titled “A2 cum LRS Declaration”) to transfer funds abroad. If you select to pay via “Domestic Bank Transfer in INR”, you may be required to fill out and submit this form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.