Loading

Get Tsx Venture Exchange - Form 5c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TSX Venture Exchange - Form 5C online

This guide provides clear and detailed instructions on how to complete the TSX Venture Exchange - Form 5C online. Whether you are new to digital document management or have some experience, this resource aims to support you in accurately filling out the required information.

Follow the steps to complete the form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

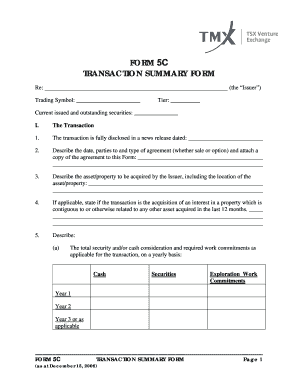

- Enter the name of the issuer in the section labeled 'Re'.

- Input the trading symbol next to 'Trading Symbol:' for easy identification.

- Specify the tier of the issuer in the field provided to categorize the filing.

- Fill in the current issued and outstanding securities under 'Current issued and outstanding securities:' which provides insight into the state of the issuer's securities.

- In 'The Transaction' section, indicate the date of the news release that fully discloses the transaction.

- Describe the date, parties involved, and type of agreement (sale or option). Attach the relevant agreement to the form.

- Detail the asset or property being acquired by the issuer, including its location.

- If applicable, disclose if the transaction pertains to an interest in a property that is contiguous to another asset acquired in the last 12 months.

- Elaborate on the security and/or cash consideration, detailing the amounts for cash and securities as well as any required exploration work commitments on a yearly basis.

- Summarize any relevant terms of the agreement, including options like NSRs and buyback provisions.

- List the names of the parties receiving securities pursuant to the transaction in tabular form, including any insider designations.

- Describe any proposed finder's fee, including the name and address of the finder.

- If the transaction involves a non-arm's length party, disclose the details of their relationship with the issuer.

- State which directors of the issuer declared a conflict of interest, along with any related governance decisions.

- Indicate if the transaction is subject to Policy 5.9 and how related requirements will be met.

- If part of a change of business (COB) or reverse takeover (RTO), explain the relevant terms.

- Provide information on expedited acquisitions, if applicable, during the previous six months.

- Calculate the maximum fees payable to the Exchange as prescribed by relevant policies.

- In the Declaration section, ensure all statements are certified as true, ensuring legal compliance.

- Have the authorized signatory complete their name, signature, and official capacity before submitting the form.

- Finally, acknowledge personal information disclosures as mandated, ensuring consent from relevant individuals.

Complete your filing of the TSX Venture Exchange - Form 5C online now!

The difference between TSX and TSX-V is in the listing requirements: TSX focuses on senior issuers, and TSX-V focuses on early-stage companies looking to access growth capital.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.