Loading

Get Interview Questionnaire For The Debtor-client - Delmar

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Interview Questionnaire For The Debtor-Client - Delmar online

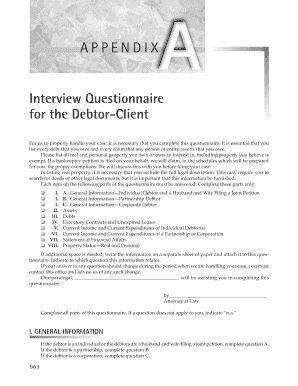

Completing the Interview Questionnaire For The Debtor-Client - Delmar is a crucial step in managing your case effectively. This guide provides clear and straightforward instructions to assist you in filling out the questionnaire accurately.

Follow the steps to complete the questionnaire with ease.

- Click the ‘Get Form’ button to obtain the questionnaire and open it in an online editor.

- Begin by filling out the General Information section. Make sure to include full names, contact details, and relevant history regarding any other names used in the past eight years for all debtors involved.

- Proceed to the section regarding your assets. Carefully list all real and personal property, ensuring you include legal descriptions and current market values. Indicate ownership types and the status of any mortgages if applicable.

- Complete the Debts section, where you will identify all existing debts. Ensure you categorize them accurately as secured or unsecured and provide all necessary creditor information.

- Move on to the Executory Contracts and Unexpired Leases section. List all contracts and leases that are still active, including contact details for counterparts and descriptions of the agreements.

- For Individual Debtors, complete the Current Income and Current Expenditures section. Estimate your average monthly income and list all regular expenses, ensuring you cover all financial aspects.

- Review the Statement of Financial Affairs carefully. Answer each inquiry fully, including questions about income, payments to creditors, and prior legal proceedings.

- Finally, check all sections for completeness. Utilize any provided space for additional notes where necessary and ensure that all responses are accurate.

- Once you have filled in the questionnaire, save your changes. You may download, print, or share the completed form as required.

Complete your questionnaire online today to ensure a smooth process in handling your case.

To get you started, here are four tricky, but common, interview questions and how to tackle them. Tell Me About Yourself. This completely open-ended opportunity to talk about yourself throws a lot of people off. ... What is Your Greatest Weakness? ... Tell Me About a Time You Failed. ... Where Do You See Yourself in 5 Years?

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.