Loading

Get Statement Of Tax Payable By Employer Section 6 A Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Statement Of Tax Payable By Employer Section 6 A Form online

This guide provides clear and supportive instructions on how to fill out the Statement Of Tax Payable By Employer Section 6 A Form online. By following each step, users can efficiently complete the form and ensure compliance with required tax obligations.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

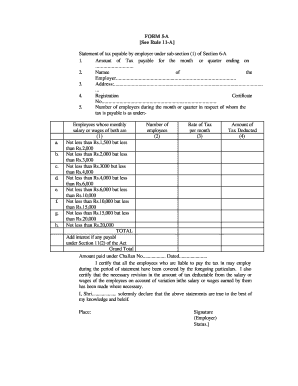

- In the first field, enter the amount of tax payable for the month or quarter ending on the specified date.

- Provide the name of the employer in the designated area; ensure accuracy as it will be used for identification.

- Fill in the employer's address to facilitate correspondence and verification.

- Enter the registration certificate number, which is necessary for validating the employer's tax status.

- List the number of employees during the month or quarter in each relevant section (a to h). Be diligent and include all necessary entries.

- Indicate the monthly salary or wage ranges in the respective columns along with the number of employees in each salary category.

- Calculate the corresponding tax amount for each employee salary category and input the totals in the designated fields.

- If applicable, add any interest payable under Section 11(2) of the Act.

- Calculate and provide the grand total of tax payable.

- Document the amount paid under the challan, including the challan number and the date of payment.

- Complete the declaration by certifying that all necessary information is accurate and true to the best of your knowledge, including your name and status.

- Finalize the form by saving your changes, and you can download, print, or share it as needed.

Complete your Statement Of Tax Payable By Employer Section 6 A Form online today to ensure your compliance!

Form W-4, Employee's Withholding Certificate, is generally completed at the start of any new job. This form tells your employer how much federal income tax withholding to keep from each paycheck. This form is crucial in determining your balance due or refund each tax season.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.