Loading

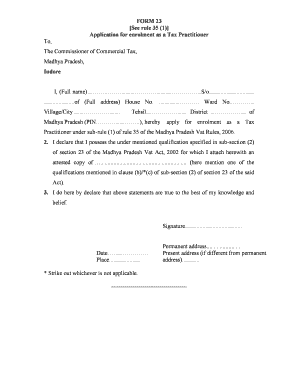

Get Faq On Enrolment As Tax Practicsner Under Mp Vat Act Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Faq On Enrolment As Tax Practicsner Under Mp Vat Act Form online

This guide provides a clear and supportive approach to completing the Faq On Enrolment As Tax Practicsner Under Mp Vat Act Form online. By following these step-by-step instructions, users can ensure that they accurately fill out the necessary information required for their enrolment.

Follow the steps to complete the enrolment form efficiently.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by providing your full name in the specified field. Make sure to include your last name followed by your first name.

- In the next field, indicate your father's name using the format 'S/o' followed by their full name.

- Fill in your full address, including house number, ward number, village or city, tehsil, and district, making sure all details are accurate.

- Enter your PIN code in the designated area to complete your address information.

- Declare your qualifications by mentioning the qualification specified in sub-section (2) of section 23 of the Madhya Pradesh Vat Act, 2002. Attach an attested copy of the relevant documents.

- In the declaration section, confirm that all statements made are true to the best of your knowledge and belief. This ensures the integrity of your application.

- Sign the form in the designated area to indicate your acknowledgment and approval of the information provided.

- Provide the date and place of signing the form. This is important for record-keeping purposes.

- If your permanent address differs from your present address, fill in the necessary fields; otherwise, you can leave it blank.

- Once all sections are completed, review the form for accuracy. You can then save your changes, download the form, print it, or share it as needed.

Start filling out your enrolment form online today for a smooth application process.

The tax practitioner's responsibilities include telling the client the truth of the situation, providing advice on how to move forward with the audit, and helping the client provide the necessary information to meet the requirements of the audit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.