Loading

Get Tc 675rs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc 675rs online

This guide provides clear instructions for successfully completing the Tc 675rs form online. Designed for users with varying levels of legal experience, this resource aims to simplify the process and ensure accurate submissions.

Follow the steps to efficiently complete the Tc 675rs online.

- Press the ‘Get Form’ button to access the Tc 675rs form and open it in your preferred digital editor.

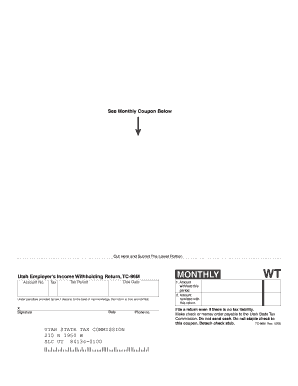

- Begin by entering your Utah withholding tax account number found on your previous tax documents. Ensure this information is accurate to avoid delays.

- Fill out the appropriate boxes with the total amount of income tax withheld for the reporting period. Be attentive to detail and use dark ink if filling out a printed version.

- Verify that the amounts match the records from your payroll or accounting systems. Double-check each entry to ensure no errors are present.

- Sign and date the form at the designated area, confirming that the information provided is true and correct to the best of your knowledge.

- Once completed, save the changes. You may choose to download, print, or share the form as needed for your records or submission.

Start completing your Tc 675rs online today and ensure a smooth filing process.

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.