Loading

Get Form G 49

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form G 49 online

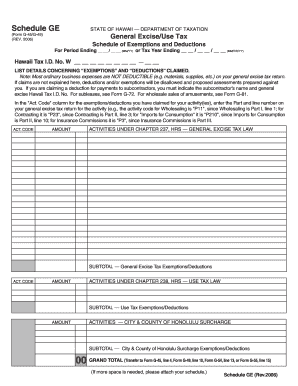

Filling out the Form G 49 online is a streamlined process that allows users to report general excise and use tax exemptions and deductions. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Form G 49 online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Fill in your Hawaii Tax I.D. Number in the designated field. Ensure that this number is correct to avoid any issues with your submissions.

- In the ‘Exemptions’ and ‘Deductions’ section, list the details of the claims you are submitting. Make sure to provide accurate and complete information to avoid disallowance of claims.

- Enter the appropriate Act. Code for each of the exemptions or deductions you've claimed. Refer to your general excise tax return for the correct Part and line numbers associated with your activities.

- Calculate the subtotal for general excise tax exemptions and deductions, and enter it in the corresponding field.

- Proceed to fill in the section for use tax exemptions and deductions, and calculate the subtotal accordingly.

- If applicable, include details for activities under the City & County of Honolulu surcharge, and provide the subtotal for this section.

- Finally, calculate the grand total of all exemptions and deductions. Transfer this total to the appropriate lines on Form G-45, Form G-49, Form G-54, or Form G-55 as instructed.

- Review all entries for accuracy, then save your changes. You can download, print, or share the form directly from the online editor.

Complete your Form G 49 online today to ensure your tax exemptions and deductions are accurately reported.

You need to get a General Excise Tax permit in Hawaii if you meet economic or physical presence nexus requirements. General Excise Tax is different than sales tax in that sales tax is a tax on customers, while General Excise Tax is a tax on businesses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.