Loading

Get Nyc-3a 2003 - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC-3A 2003 - FormSend online

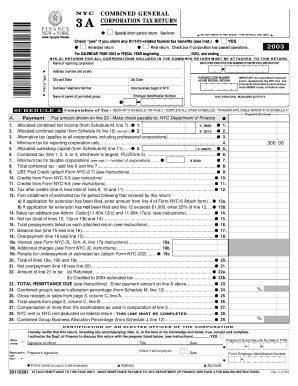

Filling out the NYC-3A 2003 - FormSend online is essential for corporations filing their general corporation tax return in New York City. This guide will provide you with clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully complete the NYC-3A 2003 - FormSend online.

- Press the ‘Get Form’ button to access the NYC-3A 2003 - FormSend online. This will allow you to open the document in a digital editor, where you can begin filling out the form.

- Start by entering the employer identification number of the reporting corporation in the designated field. This number is crucial for processing your tax return accurately.

- Next, provide the name of the reporting corporation and its address. Ensure that you print or type the information clearly to avoid any confusion.

- Indicate the tax year for which you are filing. For this form, you will either choose the calendar year 2003 or specify the fiscal year dates.

- Complete the sections regarding combined net income, allocated capital, and any applicable taxes. Be sure to calculate amounts accurately as you will reference these in subsequent schedules.

- Proceed to fill out schedules A, I, J, K, and M as required according to the instructions on the form. Each schedule will require specific information related to income, capital, and tax calculations.

- Verify all information entered is correct. This includes checking for any required attachments, such as forms NYC-9.5, NYC-9.6, or NYC-9.7, depending on your claims.

- Finally, save your changes. You will have options to download the form for your records, print it directly, or share it if necessary. Make sure to follow the mailing instructions provided on the form for submission.

Complete and submit your NYC-3A 2003 - FormSend online to ensure compliance and avoid penalties.

Single-member LLCs must file on Form NYC-202. Partnerships (including any incorporated entity other than a single-member LLC treated as a partnership for federal income tax purposes) or other unincorporated organiza- tions must file Form NYC-204 or Form 204EZ. Estates and Trusts must use Form NYC-202EIN.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.