Loading

Get 2002 Pte-ta - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2002 PTE-TA - FormSend online

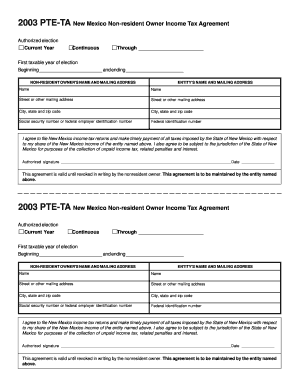

Completing the 2002 PTE-TA - FormSend online is a straightforward process that ensures compliance with New Mexico income tax regulations. This guide provides step-by-step instructions to assist users in accurately filling out each section of the form.

Follow the steps to complete the 2002 PTE-TA - FormSend effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editing platform.

- Enter the first taxable year of the election in the specified fields, providing the beginning and ending dates for that period.

- Fill in the non-resident owner's name and mailing address, ensuring all information is accurate and clearly stated.

- Input the entity's name and mailing address, following the same clarity and accuracy principles.

- Provide the social security number or federal employer identification number of the non-resident owner, and the federal identification number of the entity, if applicable.

- Read the agreement statement carefully. By completing this form, you agree to file tax returns and make timely payments regarding your share of the New Mexico income.

- Sign and date the form in the designated area to validate your agreement. Ensure the signature matches the name provided and the date reflects the current date.

- Review all entered information for accuracy. Once confirmed, you can save your changes, download, print, or share the completed form as required.

Start filling out your documents online today and ensure a smooth submission process.

PTE 84- 24, together with PTE 2020-02, reflects the Department's independent statutory authority and obligation under ERISA section 408(a) and Code section 4975(c)(2) to ensure that it only grants exemptive relief for prohibited transactions that is protective of the rights of Page 9 9 plan participants and ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.