Loading

Get Interactive Form 8283 - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Interactive Form 8283 - FormSend online

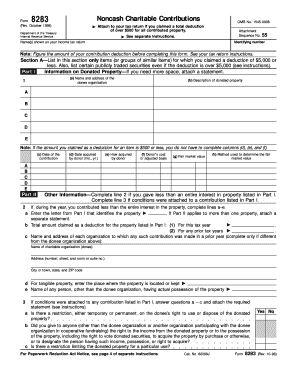

Filling out the Interactive Form 8283 - FormSend is essential for reporting noncash charitable contributions when claiming tax deductions. This guide provides step-by-step instructions to help users navigate the form effectively and ensure compliance with IRS requirements.

Follow the steps to complete the Interactive Form 8283 - FormSend online:

- Press the ‘Get Form’ button to obtain the form and open it in the interactive editor.

- Enter the name(s) shown on your income tax return in the designated field, along with your identifying number.

- In Section A, list items for which you claimed a deduction of $5,000 or less. Fill out the name and address of the donee organization, a description of the donated property, the date of contribution, the date acquired by the donor, how the donor acquired it, the donor's cost or adjusted basis, the fair market value, and the method used to determine fair market value.

- For Part II, provide additional details if you donated less than the entire interest in the property. Fill out all required fields regarding the contributions and any previous charitable organizations involved.

- In Section B, if you claimed a deduction of more than $5,000 per item or group, check the appropriate type of property and provide information on the donated property, including appraised fair market value, condition summary, date acquired, and the donor's cost.

- Complete the Taxpayer (Donor) Statement with details of any items that have an appraised value of $500 or less from Part I.

- Include the Declaration of Appraiser section with the appraiser’s signature, title, and date of appraisal to ensure proper validation.

- Finally, complete the Donee Acknowledgment by the charitable organization, entering the organization's details, date received, and authorized signature.

- Once all sections are filled out, save your changes, and choose to download, print, or share the completed form as necessary.

Start filling out your documents online today and ensure your charitable contributions are reported correctly.

Go to .irs.gov/Form8283 for instructions and the latest information. Note: Figure the amount of your contribution deduction before completing this form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.