Loading

Get Pa Inheritance Tax Return Resident Decedent (rev ... - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA Inheritance Tax Return Resident Decedent (REV ... - FormSend online

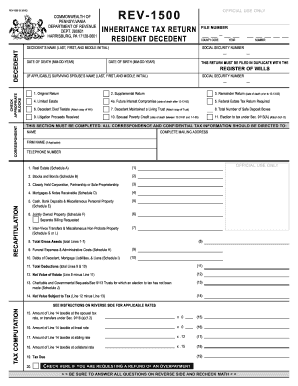

The PA Inheritance Tax Return Resident Decedent (REV ... - FormSend is an essential document for reporting estate taxes in Pennsylvania. This guide provides clear instructions on how to accurately complete the form online, ensuring compliance with state regulations.

Follow the steps to successfully fill out your inheritance tax return.

- Click 'Get Form' button to obtain the PA Inheritance Tax Return and open it in your editing tool.

- Fill in the decedent's name in the format required: Last, First, and Middle Initial. Ensure that the name matches official records.

- Enter the decedent's Social Security number accurately to avoid processing delays.

- Specify the date of death in the MM-DD-YEAR format to ensure correct tax obligations are calculated.

- If applicable, complete the surviving spouse’s name following the same format as the decedent’s name.

- Check the appropriate blocks in the provided section to indicate the type of return: Original, Supplemental, etc. Make sure to read all options carefully before selecting.

- Fill out the detailed asset sections, including Real Estate, Stocks and Bonds, and other categories listed (Schedule A-G). Ensure you provide the necessary documentation if required for specific properties.

- Calculate total gross assets by summing up the asset values entered and ensure the accuracy of your calculations.

- Complete the deductions section that will require input of funeral expenses, debts, and any other necessary deductions to determine the net value of the estate.

- Calculate the taxable amount based on the specified tax rates for different beneficiaries and enter those values in the tax computation area.

- Review the form thoroughly, double-check calculations, and ensure that all required information is complete before submission.

- Once finalized, save changes, download the completed form, print it for your records, or share it with relevant parties as needed.

Complete your PA Inheritance Tax Return online to ensure timely and accurate filing.

One way to avoid inheritance tax in PA is to make an asset joint. For example, if you have $30,000 in your name alone, and through your will, you give it to a friend of yours, it would be taxed at 15% or they would owe $4,500 in taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.