Loading

Get F-1120x - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F-1120X - FormSend online

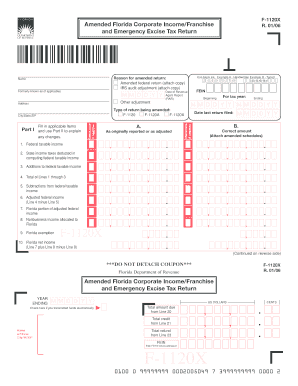

The F-1120X is used for filing an amended Florida corporate income/franchise and emergency excise tax return. This guide will assist you in navigating the form efficiently and accurately, ensuring all necessary components are completed for your online submission.

Follow the steps to successfully complete the F-1120X - FormSend online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your current name and address in the designated fields. If applicable, write the corporation's former name in the specified area.

- Indicate the reason for the amended return by selecting the appropriate checkbox. Attach necessary documentation based on the reason checked.

- In Part I, fill out all relevant data. Column A should reflect the amounts as originally reported on Form F-1120 or F-1120A, while Column B should contain the corrected amounts.

- Record the Federal Employer Identification Number (FEIN) of the corporation, along with the beginning and ending dates for the tax year in question.

- Compute the Corporate Income/Franchise Tax Due on Line 11 by applying the required tax percentage to the amounts indicated in your adjustments.

- For Lines 12 to 14, enter credits against the tax, the emergency excise tax, and the total income/franchise tax due accordingly.

- On Lines 20 to 23, complete any calculations related to amounts due or overpayments, ensuring that amounts meant for refunds or estimated tax credits are clearly indicated.

- In Part II, provide detailed explanations for all changes made to income, deductions, and credits, including any necessary attachments.

- Finally, ensure the form is signed by an authorized officer of the entity, including any preparer details if applicable.

- After completing the form, you can save changes, download for a copy, print a hard copy, or share the completed form as needed.

Complete your F-1120X - FormSend online today for a smooth filing experience.

If the correction involves an item of income, deduction or credit that must be supported by a schedule, statement or form, the corporation must attach that schedule, statement or form to its Form 1120X. The corporation must file its Form 1120X with the IRS Service Center where it filed the original return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.