Loading

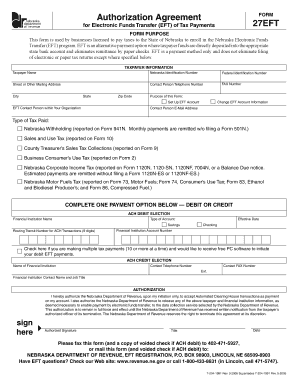

Get This Form Is Used By Businesses Licensed To Pay Taxes To The State Of Nebraska To Enroll In The

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the form used by businesses licensed to pay taxes to the State of Nebraska for online enrollment

This guide provides step-by-step instructions for accurately filling out the form required for businesses wishing to enroll in the Nebraska Electronic Funds Transfer (EFT) program. Following these detailed directions will help ensure a smooth process for setting up tax payments online.

Follow the steps to successfully complete your enrollment form.

- Click the ‘Get Form’ button to obtain the form and access it in a format suitable for completion.

- Provide taxpayer information by entering your business name, Nebraska Identification Number, Federal Identification Number, mailing address, contact person's telephone number, fax number, city, state, and zip code.

- Indicate the purpose of the form by selecting the relevant option, such as setting up an EFT account or changing EFT account information.

- Specify the type of tax paid by checking the appropriate box(es) that correspond to the taxes your business is responsible for, such as Nebraska Withholding, Sales and Use Tax, Corporate Income Tax, or Motor Fuels Tax.

- Complete the payment option section by selecting either ACH Debit or ACH Credit and filling in the required details for your chosen option, such as financial institution name, account type, routing number, and account number.

- If choosing ACH Debit, indicate if making multiple payments and request free PC software if applicable. Attach a voided check when submitting the form.

- For ACH Credit, provide information about your financial institution and the contact details of the responsible person at that institution.

- Complete the authorization section by signing, dating, and indicating your title to confirm your agreement to the EFT transactions.

- After reviewing the completed form for accuracy, you can then fax it to the provided number or mail it to the address indicated, ensuring to include any necessary attachments.

- Wait for the confirmation from the Nebraska Department of Revenue that your enrollment has been processed before attempting any EFT payments.

Begin completing your forms online to ensure your business can efficiently manage tax payments.

If you need to add sales and use tax collection to your existing Nebraska ID Number you will need to submit a Form 20, Nebraska Tax Application to the Nebraska Department of Revenue by mail or fax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.