Loading

Get Fourm329 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fourm329 Form online

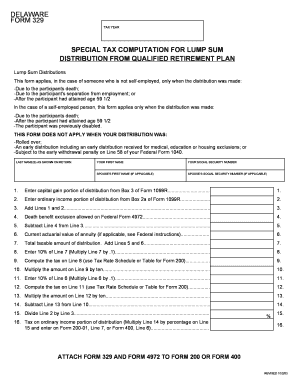

Filling out the Fourm329 Form online can seem daunting, but with this guide, we will walk you through each step to ensure a smooth process. This form is essential for reporting special tax computations related to lump-sum distributions from qualified retirement plans.

Follow the steps to accurately complete the Fourm329 Form online.

- Click ‘Get Form’ button to obtain the Fourm329 Form and open it in the editor.

- Enter your last name as it appears on your tax return in the designated field.

- Input your first name in the corresponding section.

- Provide your social security number in the specified field.

- If applicable, enter your spouse's first name and social security number.

- Complete Line 1 by entering the capital gain portion of the distribution from Box 3 of Form 1099R.

- Proceed to Line 2 and input the ordinary income portion from Box 2a of Form 1099R.

- Add the amounts from Lines 1 and 2 and enter the total on Line 3.

- If applicable, enter the death benefit exclusion on Line 4 as allowed on Federal Form 4972.

- Subtract Line 4 from Line 3 and enter the result on Line 5.

- If applicable, input the current actuarial value of the annuity on Line 6.

- Add the totals from Lines 5 and 6 to get the total taxable amount of distribution and enter it on Line 7.

- Calculate 10% of the amount on Line 7 and write it on Line 8.

- Compute the tax on Line 8 using the Tax Rate Schedule or Table for Form 200 and enter the figure on Line 9.

- Multiply the amount on Line 9 by ten and put the result on Line 10.

- Calculate 10% of the amount on Line 6 and enter this on Line 11.

- Determine the tax on Line 11 using the Tax Rate Schedule or Table for Form 200, and enter it on Line 12.

- Multiply the amount on Line 12 by ten and write the result on Line 13.

- Subtract Line 13 from Line 10 and enter the final amount on Line 14.

- Calculate the percentage by dividing Line 2 by Line 3 and enter it on Line 15.

- Multiply Line 14 by the percentage on Line 15 and enter this final amount on Line 16, which goes on Form 200-01, Line 7, or Form 400, Line 6.

- Finally, ensure that you attach Form 329 and Form 4972 to Form 200 or Form 400.

Start filling out your Fourm329 Form online today to ensure your special tax computation is accurately reported.

If a doe steps out you can shoot it, too, if you possess an antlerless deer permit; or you can shoot it with a bow, but not a crossbow, if you have an expanded antlerless permit, or a Super Pack license, which includes two expanded antlerless permits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.