Loading

Get Pa-8453 - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA-8453 - FormSend online

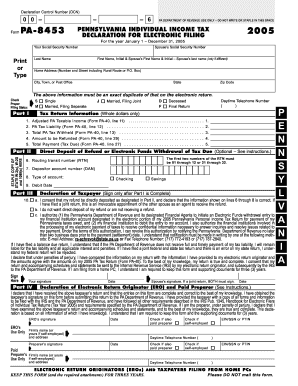

The PA-8453 - FormSend is an essential document for Pennsylvania taxpayers filing electronically. This guide provides step-by-step instructions on how to effectively fill out this form online, ensuring compliance and accuracy.

Follow the steps to complete the PA-8453 - FormSend online:

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter your Social Security Number in the designated field as it appears on your identification documents.

- Type your last name, followed by your first name and middle initial if applicable. For married couples with different last names, list both as per the guidelines.

- Provide your home address, including your street number, city, state, and zip code. Ensure this address matches what is recorded on your electronic return.

- Select your proper filing status from the provided options: Single, Married Filing Joint, Married Filing Separate, and include any additional designations if applicable.

- In Part I, fill out the tax return information: enter your Adjusted PA Taxable Income, PA Tax Liability, Total PA Tax Withheld, Amount to be Refunded, and Total Payment due, referring to the specified lines on Form PA-40.

- Complete Part II by entering your routing transit number (RTN) and depositor account number (DAN) for direct deposit or electronic withdrawal. Select the type of account and specify the desired debit date.

- In Part III, read the declaration and check the appropriate box regarding your consent for direct deposit or electronic withdrawal. Sign and date the form, ensuring both partners sign if filing jointly.

- Lastly, if applicable, Part IV requires the Electronic Return Originator’s signature along with their details, confirming that all information is accurate and complete.

- Save changes, download, print, or share the completed form as needed, ensuring you keep a copy for your records.

Start filling out your documents online today for a hassle-free filing experience.

If you are required to mail in any documentation not listed on Form 8453, you can't file the tax return electronically.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.