Loading

Get Il-941-a-x Amended Illinois Yearly Withholding Tax ... - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IL-941-A-X Amended Illinois Yearly Withholding Tax ... - FormSend online

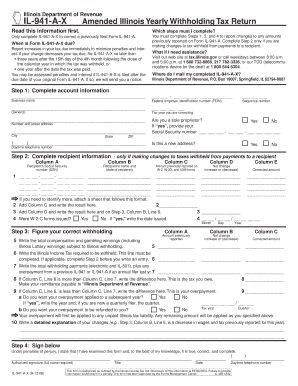

Filling out the IL-941-A-X Amended Illinois Yearly Withholding Tax form is essential for correcting previously filed tax returns. This guide provides clear, step-by-step instructions to help users efficiently complete this online form.

Follow the steps to correctly fill out your amended tax return form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete account information: Enter your business name, federal employer identification number (FEIN), sequence number, and the tax year you are correcting. If you are a sole proprietor, indicate so and provide your Social Security number. Include your address and daytime telephone number.

- Complete recipient information only if you are making changes to taxes withheld from payments to a recipient. Fill in the recipient’s Social Security number, their name, and state of residency. Report the amount previously shown on W-2, W-2G, or 1099 forms, along with any net change in amounts. Use additional sheets if necessary.

- Figure your correct withholding by writing total compensation and gambling winnings. Report the amount previously reported and any net change. Write the total withholding payments and determine if there's any tax you owe or overpayment.

- Provide detailed explanations of any changes made on the form for clarity.

- Sign the form, including your full name, title, and date. Indicate your daytime telephone number for any follow-up.

- After completing all the sections, you can save changes, download, print, or share the form as needed.

Start filling out your IL-941-A-X Amended Illinois Yearly Withholding Tax form online today.

Who must file Form IL-941? You must file Form IL-941 if you paid amounts subject to Illinois withholding income tax (either required or by voluntary agreement), such as: Wages and other employee compensation including bonus, overtime, and commission pay, usually reported to the recipient on a Form W-2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.