Loading

Get Oregon Form Oa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Oregon Form Oa online

Filling out the Oregon Form Oa online can seem daunting, but this guide is designed to simplify the process for you. By following these comprehensive steps, you can efficiently complete the form with accuracy and confidence.

Follow the steps to complete the Oregon Form Oa online.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

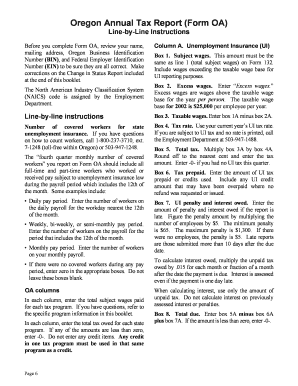

- Review your name, mailing address, Oregon Business Identification Number (BIN), and Federal Employer Identification Number (EIN) for accuracy. Make any necessary corrections on the Change in Status Report included at the end of the guide.

- Begin with Column A, entering the subject wages in Box 1. This amount should match line 1 (total subject wages) on Form 132. Ensure to include wages that exceed the taxable wage base for Unemployment Insurance (UI) reporting purposes.

- In Box 2, enter the excess wages that are above the taxable wage base for the year, which is set at $25,000 per employee.

- Calculate the taxable wages by entering the amount from Box 1 minus the amount from Box 2 in Box 3.

- Enter your current year’s UI tax rate in Box 4. If you do not have a printed rate, contact the Employment Department for assistance.

- Proceed to record the number of covered workers for state unemployment insurance for the fourth quarter. Include all full-time and part-time workers who worked or received pay subject to unemployment insurance law during the relevant payroll period.

- Continue completing Columns A and B by entering total subject wages and taxes owed for each state program in each applicable box.

- Complete the remaining boxes, including taxes prepaid, penalties, and total amounts due. Ensure that you do not leave any boxes blank if applicable, and remember to calculate any penalties or interests if the report is submitted late.

- Sign the Form OA on the designated signature line, including a phone number and the date the form was prepared. A signature is required even if you are filing a zero report.

- Once all sections are completed, save your changes. You may then download, print, or share the form as necessary.

Complete your Oregon Form Oa online today to ensure timely submission and compliance.

Use Form OR-W-4 to tell your employer or other payer how much Oregon income tax to withhold from your wages or other periodic income. Instructions for employer or other payer. Enter the business name, federal employer identification number (FEIN), and address in the “Employer use only” section of Form OR-W- 4.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.