Loading

Get West Virginia State Tax Department Charitable Bingo ... - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the West Virginia State Tax Department Charitable Bingo/Raffle FormSend online

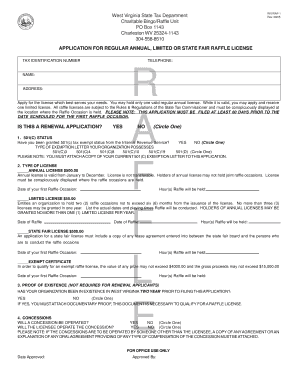

Filling out the West Virginia State Tax Department Charitable Bingo/Raffle FormSend is an essential step for organizations wishing to conduct raffles. This guide provides comprehensive, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to successfully complete your raffle license application.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the tax identification number and telephone number fields at the top of the form. Ensure that the information is accurate as it is essential for identification purposes.

- Provide your organization's name and address. Double-check the address for correctness to avoid any delays in processing.

- Select the type of raffle license you are applying for: Annual, Limited, State Fair, or Exempt Certificate. Make sure to understand the requirements and costs associated with each type.

- If applicable, indicate whether this is a renewal application by circling 'Yes' or 'No.'

- If your organization has 501(c) status, indicate that by circling 'Yes' and specify the type of exemption letter you possess.

- If applying for a Limited or Exempt license, include the dates and hours for your raffle occasions.

- Complete the proof of existence section if your organization is filing for the first time and attach the required documentation.

- Answer questions regarding concessions clearly, indicating whether they will be operated by the licensee or another party.

- List the names and contact information of officers in your organization, ensuring that all individuals are over 18 and bona fide members.

- Document the names of persons responsible for the raffle occasions. Confirm they are residents of West Virginia and record all necessary details.

- Provide the location of the raffle occasion and confirm ownership or rental status. Attach any relevant lease agreement if applicable.

- Answer all remaining questions thoroughly, including any prior license application issues.

- Fill in the name of the raffle distributor and provide their contact information.

- Describe recipient organizations of the raffle proceeds and confirm their IRS exemption status.

- Read and sign the agreement section, verifying that all information entered is truthful and accurate.

- Once all fields are completed, save your changes, download, print, or share the completed form as necessary.

Complete your raffle license application online today!

West Virginia Withholding Tax Account Number If you already have a WV Withholding Tax Account Number, you can find this on previous tax filings or correspondence from the WV State Tax Department. If you're unsure, contact the agency at 1-304-558-3333.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.