Get Utah Irp Supplemental Application - Schedule C, Tc-852 - Formsend

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Utah IRP Supplemental Application - Schedule C, TC-852 - FormSend online

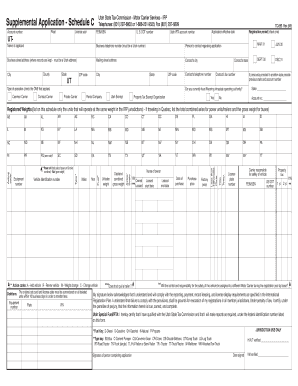

Completing the Utah IRP Supplemental Application - Schedule C, TC-852 - FormSend online is an essential process for those needing to register their vehicles for the International Registration Plan. This guide provides straightforward, step-by-step instructions to ensure that users can effectively fill out the form with ease and confidence.

Follow the steps to accurately complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your account number and the license year at the top of the form.

- Fill in your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) as applicable.

- Check the appropriate box for the registration period and specify the application effective date.

- Provide the Utah IFTA account number and U.S. DOT number, ensuring accuracy for proper tracking.

- Enter your name as the applicant, along with your business telephone number, making sure it is a valid Utah number.

- Identify a person to contact regarding this application; provide their full name, business street address, and mailing address.

- Complete the city, county, state, and ZIP codes fields for both the contact address and mailing address.

- Indicate whether you are a common carrier, private carrier, rental company, or fall under any other category listed.

- If applicable, indicate whether you have Wyoming intrastate operating authority and provide previous state and account number if previously prorated.

- List the registered weights of the units that will operate at the same weight in the IRP jurisdictions.

- For each vehicle, provide details including make, year, vehicle identification number (VIN), and the owner’s name.

- Specify additional details such as the unladen weight, declared combined gross weight, and the number of axles or seats.

- Include the action code for each vehicle, indicating whether it is an addition, renewal, weight change, or change.

- Complete the signature section, certifying that the information provided is accurate and acknowledging compliance with regulations.

- Once you have filled out all necessary fields, you can save changes, download, print, or share the completed form.

Complete your Utah IRP Supplemental Application - Schedule C, TC-852 - FormSend online today to streamline your vehicle registration process.

Complete Form W-4 so your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes. This change may also be done electronically in the Employee Self Serve System.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.