Loading

Get Form 351

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 351 online

This guide provides a clear, step-by-step approach to completing Form 351 online. Designed to assist individuals with varying levels of experience, it will ensure you understand each section and fill it out accurately.

Follow the steps to complete Form 351 online:

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

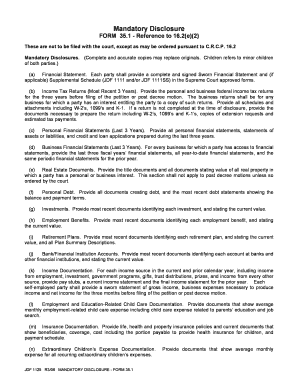

- Begin with the financial statement section. You will need to provide a complete and signed sworn financial statement along with any applicable supplemental schedules.

- Next, gather your income tax returns for the most recent three years. Ensure you include personal and business federal returns, along with all schedules and attachments, such as W-2’s, 1099’s, and K-1’s.

- Compile your personal financial statements from the last three years. This should include any statements of assets or liabilities and any credit or loan applications submitted.

- If you have a business, include the financial statements for the last three fiscal years, as well as year-to-date statements and any relevant prior year statements.

- Provide documentation related to real estate interests, including title documents and statements of value for all properties.

- Collect and submit all documents detailing personal debt, including current statements showing balances and payment terms.

- Identify your investments by submitting the most recent documents that state current values.

- List your employment benefits, providing the latest documentation that indicates their current value.

- Document your retirement plans, including the most recent papers that state their current values and plan summary descriptions.

- Provide recent documents that identify all bank and financial institution accounts, including their current values.

- For income documentation, compile pay stubs, a current income statement, and last year's final income statement for all sources of income.

- Include documents outlining average monthly employment-related child care expenses, particularly those related to education and job searching.

- Submit insurance documentation showing life, health, and property insurance policies, along with current beneficiaries, coverage details, costs, and payment schedules.

- Lastly, provide documents showing average monthly extraordinary children’s expenses.

- After completing each section, review your entries for accuracy. Once you are satisfied, you may save your changes, download, print, or share the form as needed.

Complete your documents online for a smoother experience.

Example (1). Individuals A and B, father and son, organize a corporation with 100 shares of common stock to which A transfers property worth $8,000 in exchange for 20 shares of stock, and B transfers property worth $2,000 in exchange for 80 shares of stock. No gain or loss will be recognized under section 351.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.