Loading

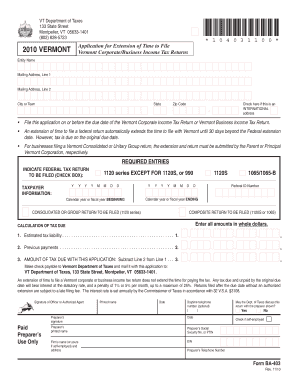

Get Form Ba-403 - State Of Vermont

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form BA-403 - State of Vermont online

Filling out the Form BA-403 is essential for requesting an extension of time to file Vermont corporate or business income tax returns. This guide provides a clear and supportive walkthrough on completing the form online, ensuring you understand each section and requirement.

Follow the steps to accurately complete the form BA-403.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by entering the entity name in the designated field at the top of the form. Ensure that the name matches the official registration to prevent any processing delays.

- Fill out the mailing address. Provide complete details in Line 1 and Line 2 as necessary. Enter the city or town, state, and zip code in the respective fields.

- If your mailing address is international, make sure to check the appropriate box that indicates it is an international address.

- Select the type of federal tax return you intend to file by checking the corresponding box. This could include options from the 1120 series except for 1120S, or 990.

- Enter your federal ID number accurately in the designated space. This is crucial for identification purposes.

- Indicate the beginning and ending dates for your calendar year or fiscal year in the specified fields.

- Complete the calculation section by providing your estimated tax liability, previous payments, and the amount due with the application. Ensure all amounts are entered in whole dollars.

- Once you have filled in all required fields, review the form for any errors or missing information to ensure accuracy.

- After verifying your entries, save your changes, and choose to download, print, or share the form as needed before submitting it to the Vermont Department of Taxes.

Complete your forms online to ensure a smooth filing process.

If you owe VT income taxes, you will either have to submit a VT tax return or extension by the April 18, 2023 tax deadline in order to avoid late filing penalties. The extension will only avoid late filing penalties until Oct. 16, 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.