Get Pa Sales Tax Exemption Form Fill In Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pa Sales Tax Exemption Form Fill In Sample online

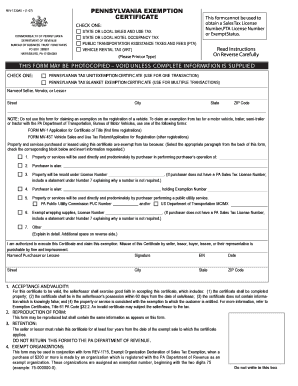

Filling out the Pennsylvania Sales Tax Exemption Form can be essential for users looking to claim exemptions on eligible purchases. This guide provides clear, step-by-step instructions to assist you in completing the form accurately online.

Follow the steps to complete the Pa Sales Tax Exemption Form effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Identify the type of exemption you are claiming by checking one of the boxes indicating either the Pennsylvania Tax Unit Exemption Certificate for a single transaction or the Pennsylvania Tax Blanket Exemption Certificate for multiple transactions.

- Fill in the name of the seller, vendor, or lessor along with their street address, city, state, and ZIP code.

- Select the reason for the exemption by checking the appropriate box and providing the necessary information related to your purchase's intended use or the exemption type.

- If applicable, include your Pennsylvania Sales Tax License Number or provide an explanation regarding why you do not have one.

- Complete the purchaser's details, including their name, signature, Employer Identification Number (EIN), date of signing, and address.

- Ensure all information is provided accurately, as misuse of the form can result in penalties. Remember to retain a copy of the form for your records.

- Once you have filled out all required fields, review the information to confirm accuracy, then save your changes, download a copy, print, or share the completed document as needed.

Start filling out your Pa Sales Tax Exemption Form online today!

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood. The Pennsylvania sales tax rate is 6 percent.

Fill Pa Sales Tax Exemption Form Fill In Sample

If purchaser does not have a PA Sales Tax License. EXEMPT ORGANIZATIONS: This form may be used in conjunction with form REV1715, Exempt Organization Declaration of Sales Tax Exemption, when a. Institutions seeking exemption from sales and use tax must complete this application.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.