Loading

Get Sf 1094

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sf 1094 online

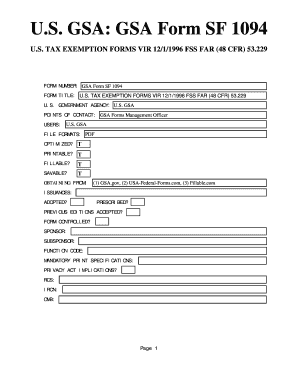

Filling out the Sf 1094 form online is a straightforward process that allows users to efficiently complete their tax exemption requests. This guide will provide step-by-step instructions to help you navigate the form with ease.

Follow the steps to accurately complete the Sf 1094 form online.

- Click ‘Get Form’ button to obtain the Sf 1094 document and open it in the editor.

- Review the introduction section of the form. Ensure that you understand the requirements for tax exemption and the eligibility criteria outlined.

- Begin filling out the personal information section. Enter your full name, address, contact information, and any relevant identification numbers as requested in the specified fields.

- Proceed to the tax exemption details section. Indicate the type of tax exemption you are applying for, including any necessary documentation or justification for your request.

- Complete the signature section by providing your signature and date. This confirms that the information provided is accurate and truthful.

- After you have completed all sections of the form, review your entries for accuracy. Make any necessary changes before finalizing.

- Once you are satisfied with the completed form, save your changes, download the document, or print and share it as needed.

Complete your documents online today for a seamless filing experience!

U.S. Treasury Department's Bureau of Federal Supply.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.