Loading

Get Electronic Filing Va6 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Electronic Filing VA-6 Form online

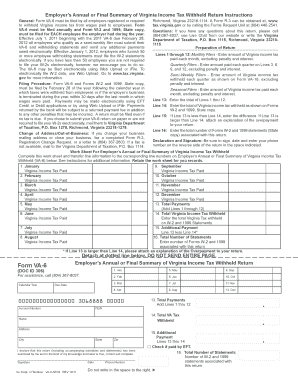

Completing the Electronic Filing VA-6 Form is essential for employers to report Virginia income tax withheld from employee wages. This guide provides clear and friendly instructions to help you navigate the online filing process effectively.

Follow the steps to complete the Electronic Filing VA-6 Form online easily.

- Press the ‘Get Form’ button to access the VA-6 Form and open it in the online editor.

- Provide your account number and FEIN at the top of the form.

- Indicate the calendar year for which you are filing the return.

- Complete Lines 1 through 12, entering the total amount of Virginia income tax paid each month or quarter as applicable, while excluding any penalties or interest.

- Sum the entries from Lines 1 through 12 on Line 13 to get your total payments.

- On Line 14, enter the total amount of Virginia income tax withheld as detailed on Forms W-2 and 1099.

- If Line 13 is less than Line 14, calculate the difference and enter it on Line 15. If Line 13 exceeds Line 14, attach an explanation of the overpayment to your submission.

- For Line 16, indicate the total number of W-2 and 1099 statements associated with this return.

- Sign, date, and provide your phone number in the designated area on the reverse side of the form.

- Review all your entries for accuracy, and then save any changes made to the form. You can download, print, or share the form as needed.

Start completing your Electronic Filing VA-6 Form online now!

File your Virginia individual income taxes for free To be sure you file your Virginia income tax return for free: Choose the software you want to use directly from our Free File page. If you access software from somewhere else - including the IRS's Free File page - you may be charged a fee to file your state return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.