Loading

Get Download Form W-3n - Formupack

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Download Form W-3N - FormuPack online

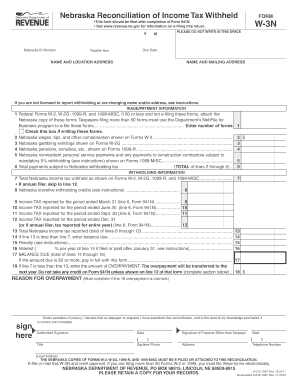

Form W-3N is a crucial document for employers in Nebraska to reconcile income tax withheld from employees. This guide provides clear instructions on how to complete this form online, ensuring you meet your reporting obligations accurately and efficiently.

Follow the steps to fill out the W-3N form online.

- Click ‘Get Form’ button to access the W-3N form and open it for editing.

- Enter your Nebraska ID number in the designated field at the top of the form. This identification number is essential for processing your submission.

- Provide the taxable year for the reconciliation in the relevant field to indicate the period this form covers.

- Fill in your name and location address in the ‘Name and Location Address’ section, followed by your mailing address in the ‘Name and Mailing Address’ section.

- In the ‘Wage/Payment Information’ section, complete lines 1 through 6. Enter the number of federal forms you are filing, followed by the Nebraska wages, gambling winnings, pensions, and other payments subject to Nebraska withholding tax.

- Proceed to the ‘Withholding Information’ section. On lines 7 through 12, input the total Nebraska income tax withheld, any incentive withholding credits, and applicable income tax amounts from your Form 941N.

- Calculate your total tax information on line 13, including balances due if applicable in lines 14-17.

- Sign and date the form in the designated signature fields, ensuring that the correct person, either a taxpayer, partner, or authorized preparer, signs.

- Once completed, you can save the changes, download, print, or share your form as required.

Take the necessary steps to complete your documents online without delay.

Form W-3 is a tax form used by employers to report combined employee income to the Internal Revenue Service (IRS) and the Social Security Administration. Employers who send out more than one Form W-2 to employees must complete and send this form to summarize their total salary payment and withholding amounts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.