Loading

Get Form 941n

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 941n online

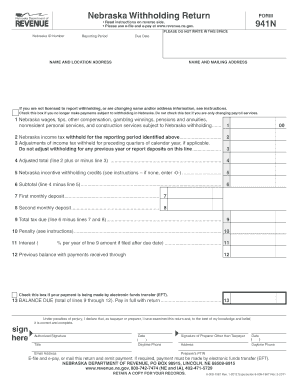

Completing Form 941n accurately is essential for businesses operating in Nebraska that need to report withholding. This guide provides clear, step-by-step instructions on how to fill out this form online, ensuring you meet your reporting obligations efficiently.

Follow the steps to complete the Form 941n online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Nebraska ID number and the reporting period at the top of the form. Ensure that all information is accurate.

- Fill in your name and mailing address in the designated fields. If there are changes to your business name or address, mark them clearly.

- If you are no longer making payments subject to withholding in Nebraska, check the appropriate box. Do not check this box if you are only changing payroll services.

- Report on line 1 the total Nebraska wages, tips, and other compensations subject to withholding for the reporting period.

- On line 2, enter the total Nebraska income tax withheld for the reporting period.

- If applicable, make adjustments for any withholding errors from earlier quarters on line 3.

- Calculate the adjusted total by adding or subtracting line 3 from line 2, and enter this on line 4.

- If you have any Nebraska incentive withholding credits, report them on line 5.

- Subtract line 5 from line 4 to determine your subtotal, and enter this on line 6.

- If you made monthly deposits, report them on lines 7 and 8.

- Calculate the total tax due by subtracting lines 7 and 8 from line 6 and enter this amount on line 9.

- If applicable, report any penalties on line 10 and interest on line 11.

- Complete line 12 with any previous balance with payments received, if applicable.

- Now, calculate the balance due on line 13 by summing lines 9 through 12, and ensure it is accurate.

- Sign and date the form in the provided fields. Include your contact information, and if someone else prepared the form, they should sign it as well.

- After reviewing all entries for accuracy, save your changes. You will have the option to download, print, or share the form as needed.

Complete your Form 941n online today to ensure timely and accurate filings!

Paper returns must be mailed to the Nebraska Department of Revenue, PO Box 98923, Lincoln, NE 68509-8923. Retain a copy of this return and all schedules and worksheets for your records. Electronic Filing (e-filing). All retailers may e-file Form 10 using NebFile for Business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.