Loading

Get Nc3x Web 8 22 03. Nc3x Web 8 22 03

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC3X Web 8 22 03 online

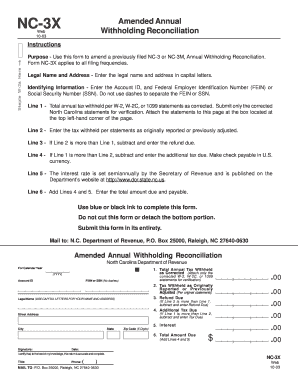

This guide provides clear and comprehensive instructions on how to complete the NC3X Web 8 22 03 amended annual withholding reconciliation form online. By following these steps, users can ensure accurate and timely submission of their amended tax information.

Follow the steps to fill out the NC3X Web 8 22 03 form accurately.

- Press the ‘Get Form’ button to access the NC3X Web 8 22 03 form in your preferred editor.

- Enter your legal name and address in capital letters in the designated fields. Ensure that the information is accurate to avoid any processing delays.

- Input the Identifying Information, including your Account ID and either your Federal Employer Identification Number (FEIN) or Social Security Number (SSN). Do not include dashes when entering your FEIN or SSN.

- Complete Line 1 by entering the total annual tax withheld per W-2, W-2C, or 1099 statements as corrected. Only include the corrected statements for verification and attach them in the box located at the top left-hand corner of the page.

- For Line 2, input the tax withheld as originally reported or previously adjusted. Ensure that this information reflects your initial submissions.

- If the amount on Line 2 exceeds that of Line 1, subtract Line 1 from Line 2 and report the refund due on Line 3.

- If Line 1 exceeds Line 2, subtract Line 2 from Line 1 and enter the additional tax due on Line 4. Make any checks payable in U.S. currency.

- In Line 5, note that the interest rate is set semiannually by the Secretary of Revenue, and you can find the current rate on the Department’s website.

- Calculate the total amount due by adding the figures from Lines 4 and 5, and enter this amount on Line 6.

- Use blue or black ink to write on the form. Do not cut or detach any portion of the form. Ensure you submit it in its entirety.

- Sign and date the form at the designated areas to certify that the return is accurate and complete. Include your title and contact phone number.

- Once completed, save your changes, then download and print the form for submission. Mail it to the N.C. Department of Revenue at the address provided.

Complete your NC3X Web 8 22 03 form online today to ensure compliance and accuracy in your tax filings.

Am I required to file Form NC-3? You must file Form NC-3 if you are required to withhold or you voluntarily withheld North Carolina income taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.