Loading

Get California Form 592f 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the California Form 592f 2013 online

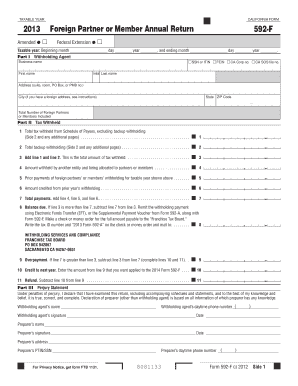

Filling out the California Form 592f, intended for foreign partners or members, requires careful attention to detail. This guide provides a clear, step-by-step approach to completing the form online, ensuring compliance with California tax regulations.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxable year in the specified fields, including the beginning and ending months, days, and years.

- In Part I, provide the withholding agent's information. Select the applicable identification number type by checking the appropriate box next to SSN, ITIN, FEIN, CA Corp no., or CA SOS file no. Fill in the business name, contact details, and total number of foreign partners or members included.

- Move to Part II, where you will report the tax withheld. Enter totals from your Schedule of Payees for lines 1 and 2, then calculate line 3 by adding these amounts.

- Continue in Part II to report any amounts withheld by another entity and prior payments. Ensure accuracy as line 8 requires you to determine if there is any balance due by comparing total tax withheld to total payments.

- In Part III, complete the perjury statement. Ensure all required names and signatures are included, and remember to provide the preparer's information if applicable.

- Once the form is fully completed, review all entries for accuracy. Save your changes, and proceed to download or print the form as required.

- Following verification, submit your completed Form 592f online, ensuring to remit any required payments according to the instructions provided.

Complete your California Form 592f online today to ensure proper tax reporting and compliance.

You may not have to withhold if: Total payments or distributions are $1,500 or less. Paying for goods. Paying for services performed outside of California.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.