Loading

Get Form Nrw Exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Nrw Exemption online

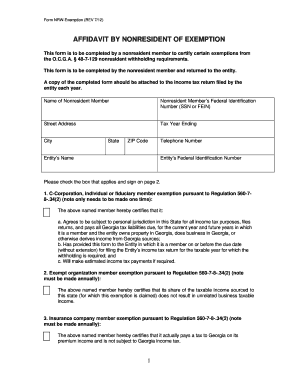

Filling out the Form Nrw Exemption is essential for nonresident members to certify exemptions from certain withholding requirements. This guide will provide clear, step-by-step instructions for completing the form online, ensuring that you understand each component and requirement.

Follow the steps to successfully complete the Form Nrw Exemption.

- Click ‘Get Form’ button to obtain the form and open it in the relevant editor.

- Enter the name of the nonresident member in the designated field at the top of the form.

- Provide the nonresident member’s Federal Identification Number, which can be either their Social Security Number (SSN) or Federal Employer Identification Number (FEIN).

- Fill in the street address, city, state, and ZIP code of the nonresident member.

- Specify the tax year ending for which the exemption is being claimed.

- Enter the name of the entity to which the nonresident member belongs, along with its Federal Identification Number.

- Complete the telephone number field for contact purposes.

- Review the applicable exemption boxes on the second page of the form. Choose the box that aligns with your exemption type, such as C-Corporation or exempt organization, and provide the necessary certifications.

- Ensure that the designated individual, fiduciary, or authorized officer signs the form on the signature line provided.

- Finally, enter the date of signature and print the name of the individual, fiduciary, or authorized officer on the designated line.

- Once all fields are completed, you can save the changes made to the form, as well as download, print, or share the completed document as needed.

Take action today and complete your Form Nrw Exemption online to ensure compliance with tax requirements.

§ 48-7-27. Married Filing Jointly. In the case of a married couple filing jointly, each spouse shall if otherwise qualified be individually entitled to exclude retirement income received by that spouse up to the exclusion amount for such spouse. Taxpayers must qualify on a separate basis.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.