Loading

Get Form 3544

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3544 online

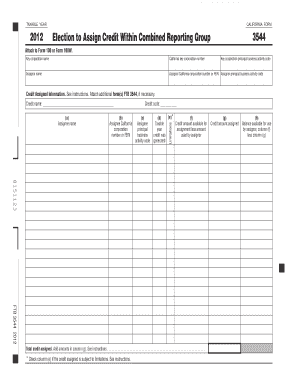

Filling out Form 3544 is essential for California taxpayers who wish to assign credits within a combined reporting group. This guide provides clear and detailed instructions on completing each section of the form online, ensuring you can navigate the process smoothly.

Follow the steps to fill out Form 3544 online.

- Press the 'Get Form' button to obtain the Form 3544 and open it in your preferred online editor.

- Begin by entering the key corporation name, California key corporation number, and the principal business activity code at the top of the form.

- Fill in the assignor's information, including the assignor name, California corporation number or federal employer identification number (FEIN), and the assignor's principal business activity code.

- Navigate to the credit assigned information section. Enter the credit name and code in the provided spaces. Make sure to consult the Credit Chart in the related tax booklet for eligible credits.

- Complete each column for the assignee's information. Provide the assignee's name in column (a), California corporation number or FEIN in column (b), and principal business activity code in column (c).

- Indicate the taxable year the credit was generated in column (d). Specify whether the assigned credit is subject to limitations by checking column (e).

- Enter the credit amount available for assignment in column (f). This should reflect the amount less what was used by the assignor.

- In column (g), record the credit amount being assigned to the assignee. Ensure you keep track of how much credit has been assigned.

- Calculate the balance available for the assignor in column (h) by subtracting the assigned amount from the available credit amount.

- Finally, total the credit amounts assigned by adding values in column (g) and ensure all entries are complete before saving changes, downloading, printing, or sharing the form.

Complete your documents online to ensure timely and accurate filing.

Tax-Credit Method Under the tax-credit method, a tax is calculated on every transaction. The tax rate is applied to the price the firm charges, the tax is calcu- lated, and then printed on the sales or purchase invoice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.