Loading

Get Form It 40p - Ohio Department Of Taxation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

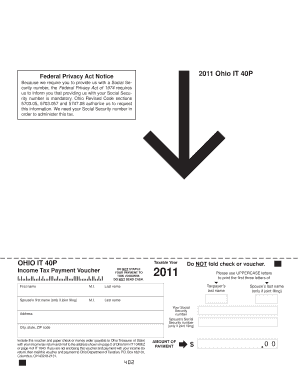

How to fill out the Form IT 40P - Ohio Department Of Taxation online

Completing the Form IT 40P for the Ohio Department of Taxation online can facilitate your tax payment process. This guide provides simple, step-by-step instructions to ensure that you accurately fill out and submit your form.

Follow the steps to successfully complete your Form IT 40P.

- Click ‘Get Form’ button to obtain the form and open it in your online tool.

- Specify the taxable year by entering '2011' in the designated field.

- Enter your last name in uppercase letters, followed by your first name in the corresponding fields.

- If filing jointly, insert your spouse’s first name and last name in the appropriate fields.

- Fill in your Social Security number and, if applicable, your spouse's Social Security number.

- Provide your complete address, including city, state, and ZIP code.

- Indicate the amount of your payment in the ‘AMOUNT OF PAYMENT’ section.

- Review all fields for accuracy and ensure that no sections are left blank.

- Once completed, save your changes, and download, print, or share the form as required.

Take the next step and complete your Form IT 40P online today!

Personal and Dependent Exemption amounts are indexed for tax year 2020. If Modified Adjusted Gross Income is: • Less than or equal to $40,000, the exemption amount is $2,400. Greater than $40,000 but less than or equal to $80,000, the exemption amount is $2,150. Greater than $80,000, the exemption amount is $1,900.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.