Loading

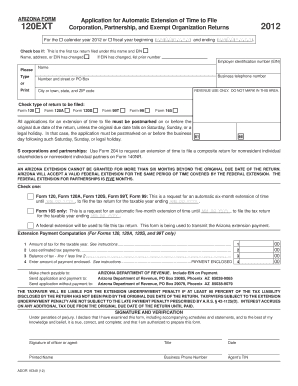

Get Arizona 120 Ext Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arizona 120 Ext Fillable online

This guide provides clear, step-by-step instructions for users on how to fill out the Arizona 120 Ext Fillable form online. Whether you're new to digital document management or familiar with tax extensions, this guide is designed to help you navigate the process with ease.

Follow the steps to complete the Arizona 120 Ext Fillable online efficiently.

- Click ‘Get Form’ button to access the Arizona 120 Ext Fillable form and open it in your preferred online document editor.

- Fill in the required information at the top of the form. This includes the tax year for which you are requesting an extension, and if applicable, checking the box indicating a name or EIN change.

- Enter your employer identification number (EIN), and ensure all business details such as your name, address, and business telephone number are accurate.

- Select the type of return you are planning to file from the options provided, ensuring it matches your business needs.

- Complete the extension payment computation section if applicable. Here you will input your estimated tax amount, previous payments, and the balance due, along with the payment enclosed amount.

- Sign and date the form. Your signature acts as verification that the information provided is complete and correct to the best of your knowledge.

- Review your completed form for accuracy before saving. Once satisfied, you can save changes, download, print, or share the form as needed.

Begin managing your documents effectively by completing your Arizona 120 Ext Fillable form online today.

Can I submit a filing extension request online for Individual Income or Small Business Income Tax? No. However, if you have an approved federal extension from the Internal Revenue Service, you do not need to file an extension with Arizona.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.