Loading

Get Simple Ira Contribution Remittance - Wells Fargo Advantage Funds

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SIMPLE IRA Contribution Remittance - Wells Fargo Advantage Funds online

This guide provides users with comprehensive instructions on how to accurately complete the SIMPLE IRA Contribution Remittance form for Wells Fargo Advantage Funds online. By following these steps, you will ensure that your contributions are properly remitted for processing.

Follow the steps to successfully complete the SIMPLE IRA Contribution Remittance form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

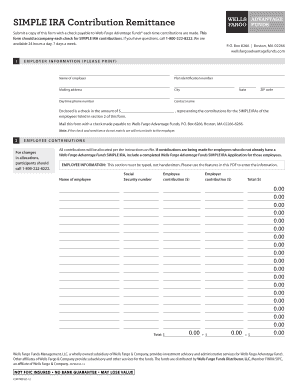

- In the Employer Information section, provide the following details: the name of the employer, plan identification number, mailing address, city, state, ZIP code, daytime phone number, and a contact name.

- Indicate the total amount of the contribution by entering the amount enclosed in the provided field. This should represent the contributions for the SIMPLE IRAs of the employees listed in the next section.

- In the Employee Contributions section, ensure that this part is typed, not handwritten. Enter the employee’s name, Social Security number, employee contribution amount, and employer contribution amount for each employee.

- Make sure to calculate and total the contributions in the Total section. This should include the employee contribution and the employer contribution, adding them together for the final amount.

- If there are employees who do not already have a Wells Fargo Advantage Funds SIMPLE IRA, ensure to include a completed Wells Fargo Advantage Funds SIMPLE IRA Application for those employees.

- Once all fields are completed and double-checked for accuracy, users can then save their changes, download a copy, print it, or share the completed form as necessary.

Complete your SIMPLE IRA Contribution Remittance form online today for efficient processing.

Once you open an account, you can fund an IRA with cash, a check or a direct transfer from your bank.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.