Loading

Get Form 2 City Of Richmond Net Profit.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2 City Of Richmond Net Profit.doc online

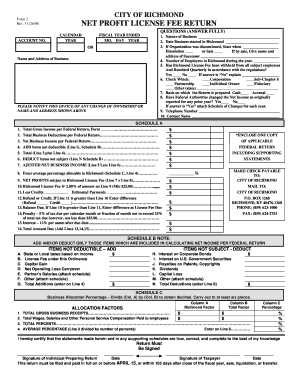

Filling out the Form 2 City Of Richmond Net Profit is essential for businesses to accurately report their net profits and comply with local regulations. This guide provides clear, step-by-step instructions to assist users in completing the form online without hassle.

Follow the steps to effectively complete the form.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter your account number in the designated field, ensuring it matches your records.

- Describe the nature of your business in the provided space, keeping it concise yet informative.

- Indicate the date your business started operations in Richmond.

- If applicable, state when your organization was discontinued and indicate if it was due to dissolution or sale.

- Input the number of employees working in Richmond during the year.

- Respond to the question about whether the Richmond License Fee has been withheld and remitted, providing explanations if necessary.

- Select the appropriate business structure from the checklist, marking one option.

- Answer if federal authorities have changed your net income for any prior year, attaching a schedule if necessary.

- Provide your telephone number and contact name for further communication.

- Complete Schedule A by meticulously filling out gross income, business deductions, and calculating the adjusted net business income.

- Review the total amount due, including penalties and interest, if applicable.

- Certify the accuracy of the information by signing the form, and include dates.

Complete your Form 2 City Of Richmond Net Profit.doc online today to ensure accurate and timely filing.

Unlike some other states, Kentucky has no local taxes and only one state payroll tax form, making it one of the easiest states to manage your company's payroll. Chapter 141 of the revised Kentucky Law requires employers to withhold income tax on both resident and non-resident employees (unless exempt from the law).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.