Loading

Get Charitable Trust Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Charitable Trust Form online

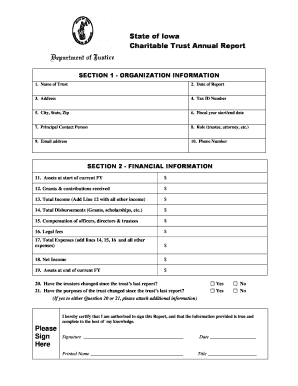

Completing the Charitable Trust Form online is a streamlined process that ensures your charitable trust complies with its reporting requirements. This guide provides clear and detailed instructions to help you through each section of the form, ensuring accuracy and completeness.

Follow the steps to successfully complete the Charitable Trust Form

- Click the ‘Get Form’ button to access the Charitable Trust Form. This action will allow you to open the form in your online editor.

- In Section 1, provide the organization information by filling in the name of the trust, the date of the report, and the complete address, including city, state, and zip code. Ensure that you include the tax ID number and fiscal year start and end dates.

- Move to Section 2, where you will input financial information. Start with the assets at the beginning of the current fiscal year, then report on grants and contributions received, totaling all income on the specified line.

- Certify the accuracy of your report by signing and dating the form where indicated. Add your printed name and title before submitting the finalized document.

- Once you complete the form, you can save your changes, download, print, or share the document as needed.

Complete your Charitable Trust Form online today to ensure your organization remains in compliance with reporting requirements.

Nonexempt charitable trusts report revenue and expenses on Form 990-PF, which differ somewhat from the income and deduction items reported on Form 1041. However, amounts reported for income items such as interest and ordinary dividends closely mirrored data reported on the income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.