Loading

Get California State Board Of Equalization Transient Occupancy Tax Exemption Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the California State Board Of Equalization Transient Occupancy Tax Exemption Form online

This guide provides clear, step-by-step instructions on how to complete the California State Board Of Equalization Transient Occupancy Tax Exemption Form online. Follow these detailed instructions to ensure you fill out the form correctly and efficiently.

Follow the steps to complete your exemption form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

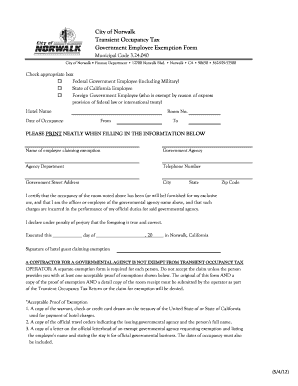

- Review the first section of the form where you will need to check the appropriate box to indicate your employment status—choose from federal government employee, state of California employee, or foreign government employee.

- In the next section, enter the hotel name and the room number you occupied during your stay.

- Fill in the dates of your occupancy by specifying the check-in and check-out dates in the designated fields.

- Clearly print your name as the employee claiming the exemption in the provided field.

- Specify the government agency you are employed by, and provide the department associated with your agency.

- Include your telephone number for contact purposes and your government street address, city, state, and zip code.

- Confirm your eligibility for the exemption by reading and signing the certification statement in the form.

- Make sure you date your signature accordingly and enter the day and month.

- Ensure you have all required documentation, such as proof of exemption, and prepare to submit the original form along with copies of proof and room receipt as instructed.

- Finally, save changes, download, print, or share the completed exemption form as needed.

Complete your documents online efficiently by following these steps!

Transient Occupancy Tax is collected from all hotels, motels, bed and breakfast, or other establishment that provides transient occupancy in the unincorporated areas of the county. Transient Occupancy Tax is 9% of the rental rate and is paid quarterly to the Tax Collector.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.